To test how credit card fraud might result from using one to subscribe to a piracy subscription, investigators used a dedicated credit card to sign up for 20 such services. Within two weeks they were targeted for nearly $1,500 in illicit purchases, which were identified as charges for grocery delivery, women’s apparel, computer software, and a cash advance. An unattributed charge of $850 was caught and escalated for consumer approval by the credit card company.

Piracy subscribers using credit cards were four times more likely to report fraudulent Card purchases, according to “Giving Piracy Operators Credit,” a study released in June 2023 by the Digital Citizens Alliance. In all, 72 percent of those who used a credit card to sign up for a piracy service reported credit card fraud.

Unauthorized charges appeared to originate from China, Singapore, Hong Kong, Lithuania – and Abita Springs Louisiana.

Accompanying survey

In addition to that investigation, a May 2023 survey commissioned by Digital Citizens asked 2,330 Americans how they get their entertainment, to better understand the risks of piracy websites and apps.

Key findings include:

- Roughly 1 in 3 Americans reported watching pirated content at least once over the past year. Some relied on pirated content after canceling other legitimate streaming options or cable or satellite services.

- About 1 in 10 who reported watching pirated content said they had purchased a subscription using a credit card to do so.

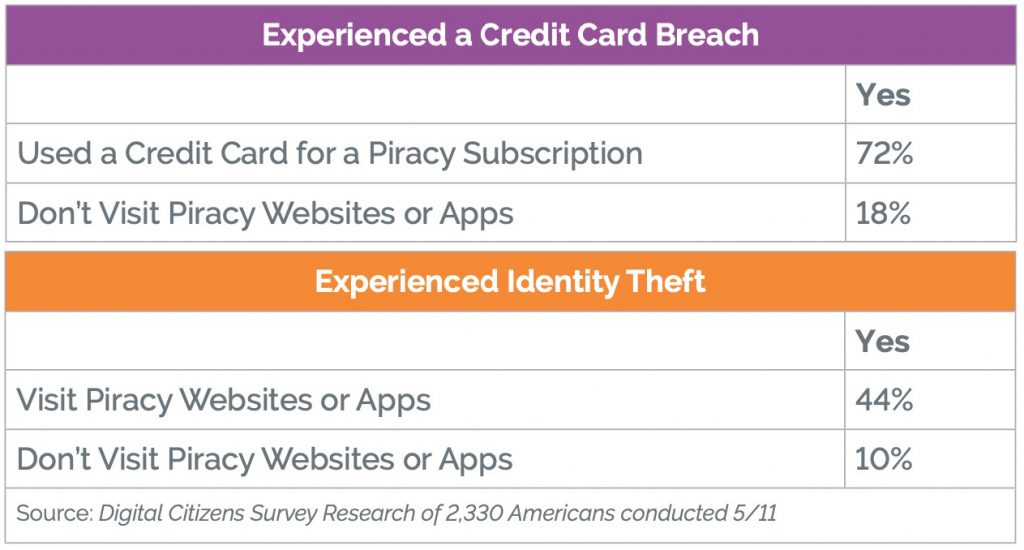

- Seventy-two percent of Americans who said they used a credit card to purchase a piracy subscription service also reported having an issue with credit card fraud over the last year. Only 18 percent of those who said they don’t visit pirate sites reported a similar issue.

- Americans who visited piracy sites and apps were four times (44 percent to 10 percent) more likely to report being a victim of identity theft.

- Americans who visited piracy sites and apps were five times (46 percent to 9 percent) more likely to report having an issue with malware in the last year.

Additional risks

The study notes that in recent years, piracy has been closely linked to the spread of dangerous malware that encrypted files on the user’s computer and then demanded payment to unlock them.

According to the Federal Trade Commission, Americans lost $5.8 billion from credit card fraud in 2021, more than double what occurred in 2020.

Further reading

Giving Piracy Operators Credit: How Signing Up for Piracy Subscription Services Ratchets Up the User Risk of Credit Card Theft and Other Harms. Report. June 20, 2023. Digital Citizens Alliance

Why it matters

Credit card fraud is one of the many forms of damage inflicted against consumers who take piracy services. In many cases, consumers aren’t aware that the services are illegal, nor may they be aware that the transaction might have caused the fraud to occur.

Digital Citizens Alliance calls for concerted action by federal and state governments, the credit card companies that piracy operators rely on, and consumers themselves. Those efforts should include:

- Payment processors terminating relationships with known piracy operators.

- The FTC warning Americans about online risks that can expose them to financial fraud and malware.

- Law enforcement using the tools they were given in 2020 to launch criminal investigations against piracy operators.

- Consumer protection groups continuing to warn Americans about the risks.