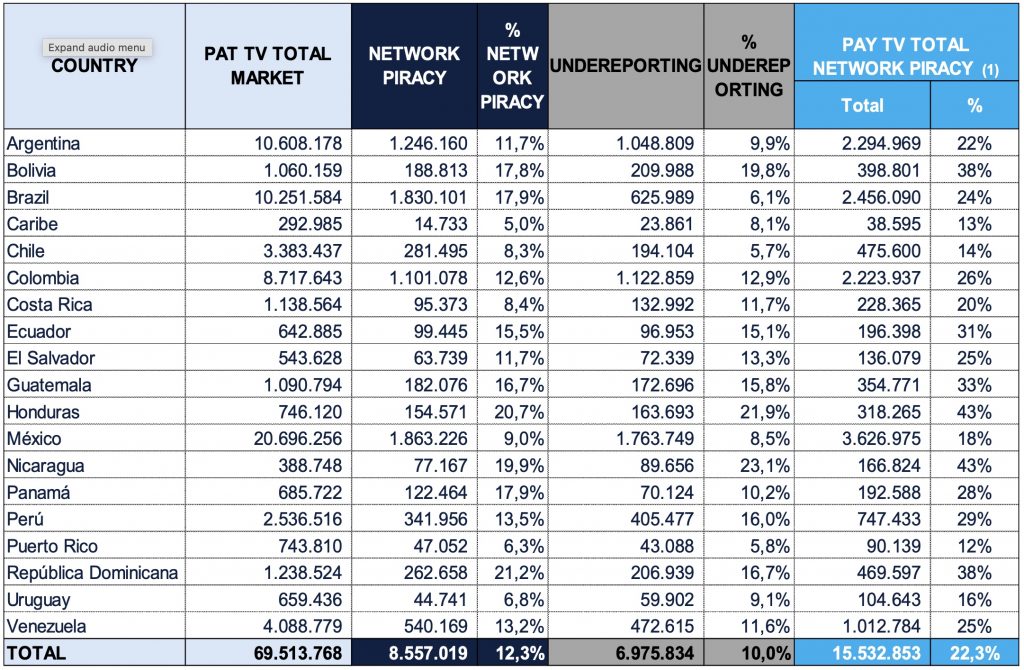

The number of residential Pay TV subscribers in Latin America and the Caribbean accessing pay TV signals illegally, plus underreporting, exceeds the number of subscribers to any legitimate pay TV service in the region.

About 22.3% of the more than 69.5 million in that region access pay TV programming through illegal means, according to a report conducted by BB Media and released by ALIANZA (the Anti-Piracy Audiovisual Alliance) in November 2025.

The report estimated the annual losses to piracy by Pay TV operators to be about US$2.5 billion, and about US$1.8 billion lost by TV programmers. Lost tax revenues to governments in the region was estimated at about US$787M. Piracy also cost regional economies about 31,000 jobs.

The report covers 22 countries: Argentina, Bolivia, Brazil, Caribe (Aruba, Barbados, Curacao, Trinidad y Tobago), Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, México, Nicaragua, Panamá, Perú, Puerto Rico, República Dominicana, Uruguay and Venezuela

Out of a total of 205.6 million households in the region, 47.7 million (23.2%) subscribers were reported by operators. BB Media estimated that the real number of TV households was 69.5 million, in which the additional 21.8 million represented under-reporting.

Of this 69.5 million TV households, BB Media estimated that 8.6 million households (12.3%) accessed piracy sources and an additional 7 million (10%) were under-reported.

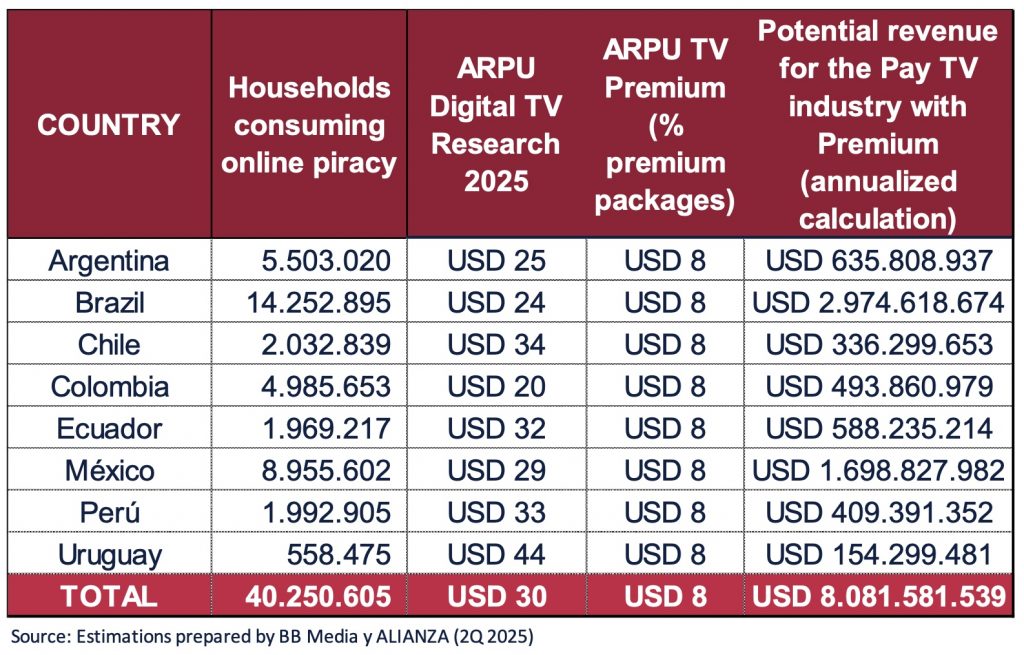

Online video piracy losses were much worse

The loss rates reported for Pay TV pale in comparison to losses due to online piracy, from streaming, stream ripping, downloads, public and private torrenting, social media sources.

Pirate sources were consumed by an estimated 40 million households, for an annualized loss of over US$8 billion.

Lost tax revenues from online piracy were estimated at about US$1.5 billion. Job losses were estimated at about 40,000.

These estimates were in addition to the losses to pay TV operators, programmers and government tax agencies.

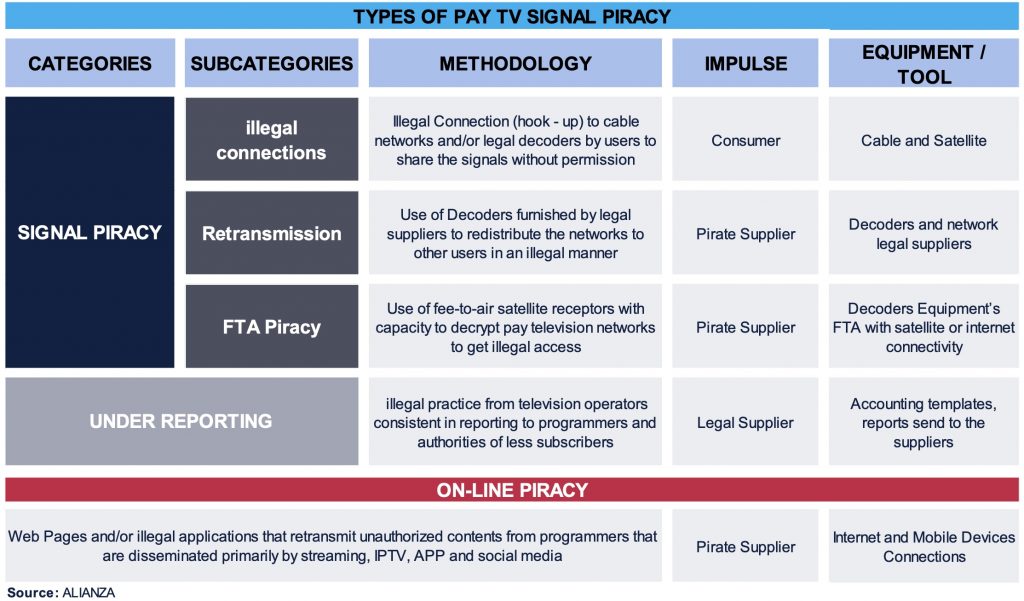

Methodologies

The researcher of this report, Business Bureau Media (BB Media), has a database of over 25.000 Pay TV operations (legal and illegal) in Latin America and the Caribbean. To calculate the penetration of piracy through illegal connections, retransmission, and underreporting, it conducted automated surveys to build a sample with a 95.5% confidence interval and a sample margin of error of less than 4%.

Underreported subscribers are identified by comparing the number of subscribers by Pay TV provider detected by BB Media surveys to the publicly reported number to the government authority and the number privately reported to programmers

To analyze the impact of online piracy, BB Media collected data through online surveys of individuals between 16-65 years of age, with fixed-line broadband internet access.

Why it matters

Pay TV and online piracy represent a multi-billion-dollar problem in Latin America and the Caribbean. It poses significant challenges for pay television operators, programmers, governments, and consumers alike.

Further reading

Pay Television Network & Online Piracy 2Q-2025. Research report. November 2025. Conducted by BB Media for Alianza Contra la Pirateria Audiovisual (Anti-Piracy Audiovisual Alliance, ALIANZA), Latin America